When you’re trading Forex, you’re dealing with short-term price trends, so you need to understand technical patterns.

Aug 07, 2025

Basics

When you’re trading Forex, you’re dealing with short-term price trends, so you need to understand technical patterns.

This article aims to demystify the complexities of bullish and bearish flag patterns and offer traders of all experience levels — from novice to expert — a solid knowledge to forecast and capitalize on market movements effectively.

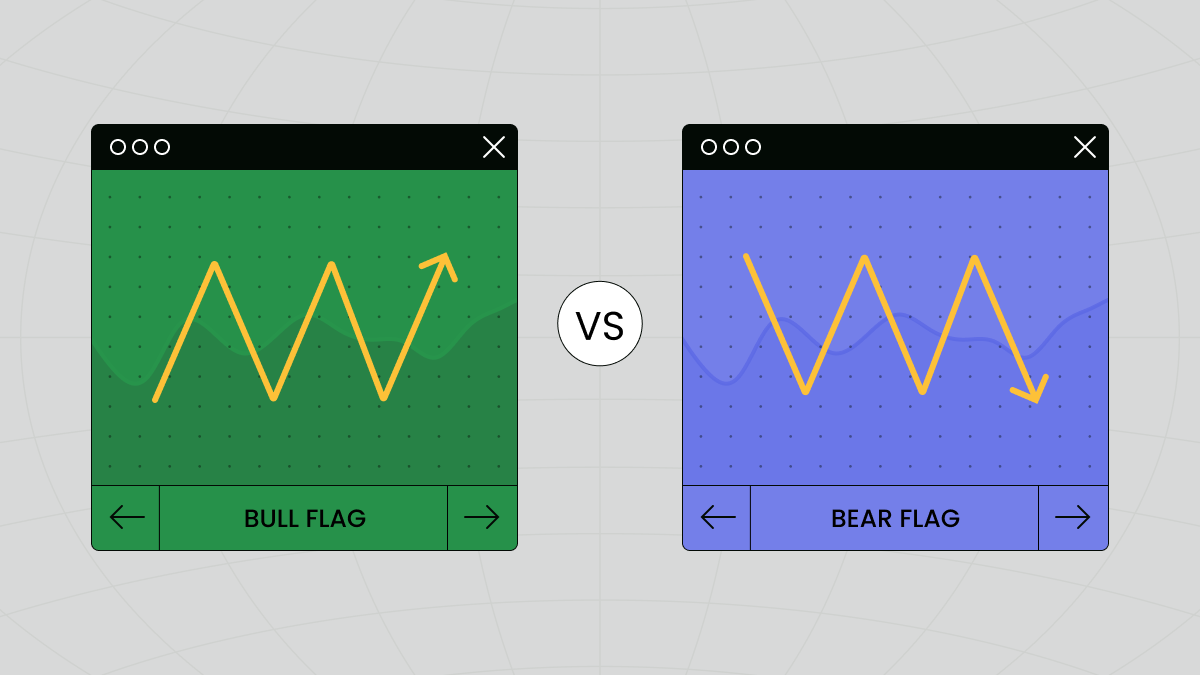

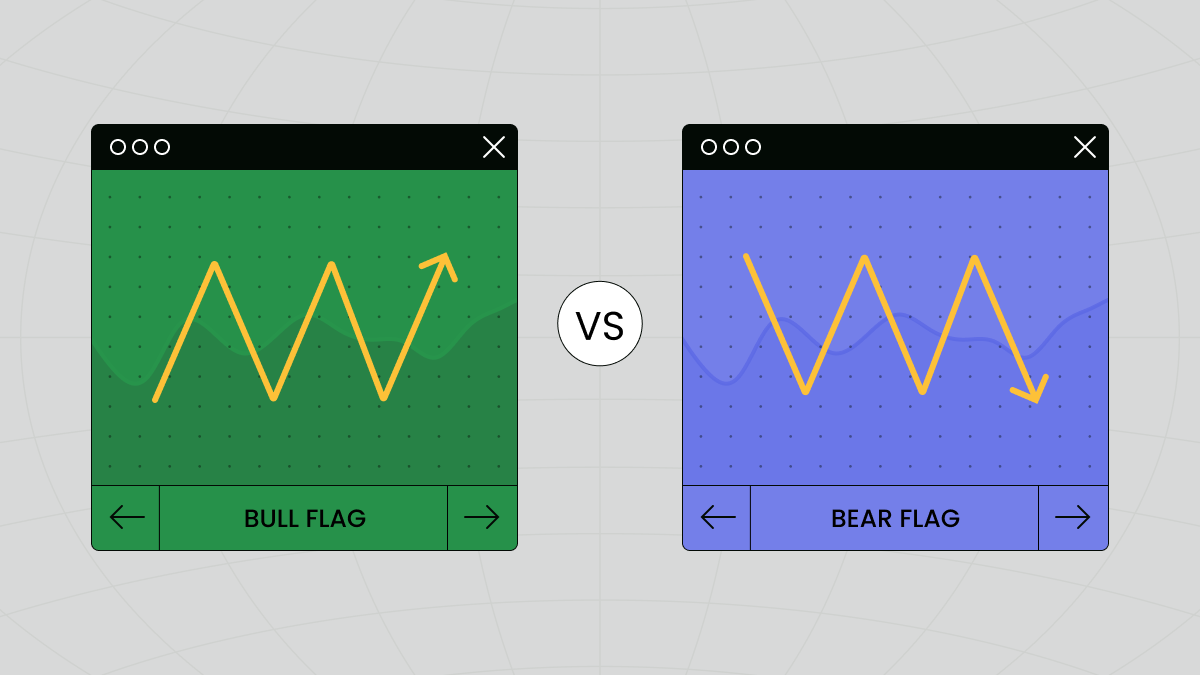

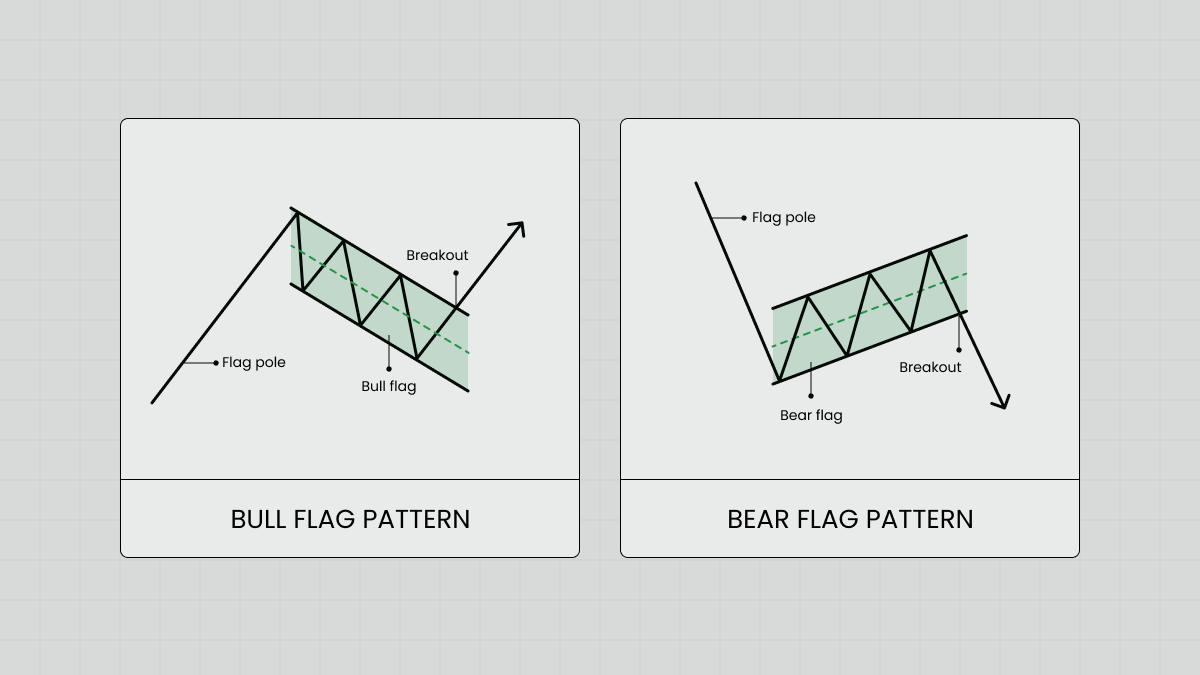

Bullish and bearish flags are short-term continuation patterns in the Forex market. The patterns resemble a flag on a pole, which explains their name. In Forex, such a flag indicates a potential continuation in the direction of the prior trend.

All downtrends end, and the price reverses upward. One way to recognize when this is about to happen is when you see an upward flagpole (a steep rise in price), which is then followed by a downward consolidation that looks like a flag. If, after this flag, the price continues to climb, and goes higher than the flag did, you’ve got a bullish flag pattern.

All uptrends reverse eventually as well. When you see a downward flagpole, then an upward consolidation, and then the price continues to drop past the bottom of the flag, you’re dealing with a bearish flag pattern.

Here are some essential aspects of flag patterns that confirm their significance in trading:

Bullish and bearish flags are great at predicting trend continuation with high probability.

Flag patterns are at the top of the analysis tool game as far as reliability and clarity.

Flag patterns are so well defined that traders are able to set very precise stop-losses and take-profits.

During the flag, which tends to have lower volume, traders can enter without a huge amount of risk.

Whether you’re a day trader, a swing trader, or a long-term investor, you may find flag patterns useful.

Using bullish and bearish flag patterns effectively requires a keen eye for detail and a solid strategy for execution.

Here are some practical steps to incorporate these patterns into your trading approach:

The first step is to identify the presence of a flag pattern accurately. Look for a sharp price movement, which forms the flagpole, followed by a more minor, counter-trend consolidation phase, which forms the flag.

Remember, the consolidation should ideally be less volatile and confined within a narrow price range.

Volume plays a crucial role in confirming the validity of a flag pattern. Typically, the volume should spike during the flagpole formation, decrease as the flag is formed, and increase again during the breakout. This pattern in volume helps confirm the continuation signal provided by the price breakout.

Patience is vital when trading flag patterns. Wait for the price to break out of the flag formation conclusively. This means the price should close outside of the consolidation boundary. A premature entry before a confirmed breakout can lead to false signals and potential losses.

Once a pattern is confirmed, set your entry point:

Bullish flag: Enter a long position after the price breaks above the flag.

Bearish flag: Enter a short position when the price drops below the flag.

To manage risk effectively, set a Stop Loss order:

Bullish flag: Place a Stop Loss slightly below the lowest point within the flag.

Bearish flag: Place a Stop Loss just above the highest point within the flag.

Take Profit can be set at a distance equal to the length of the flagpole added to the breakout point, projecting a similar move post-breakout.

When you enter a trade, closely monitor market conditions and price action. If the market shows signs of changing conditions or if the expected price move extends beyond initial projections, be prepared to adjust your Stop Loss and Take Profit levels.

Each trade offers valuable lessons. Review your trades to understand what worked and what didn’t. This continual learning process will refine your ability to identify and capitalize on flag patterns.

At FBS, we are committed to providing traders with the tools, resources, and support needed to succeed in the dynamic world of Forex trading. We encourage you to use the insights from this guide to refine your trading strategies and take full advantage of the opportunities that bullish and bearish flag patterns present.

By registering, you accept FBS Customer Agreement conditions and FBS Privacy Policy and assume all risks inherent with trading operations on the world financial markets.