How to identify and trade an Inside Bar setup

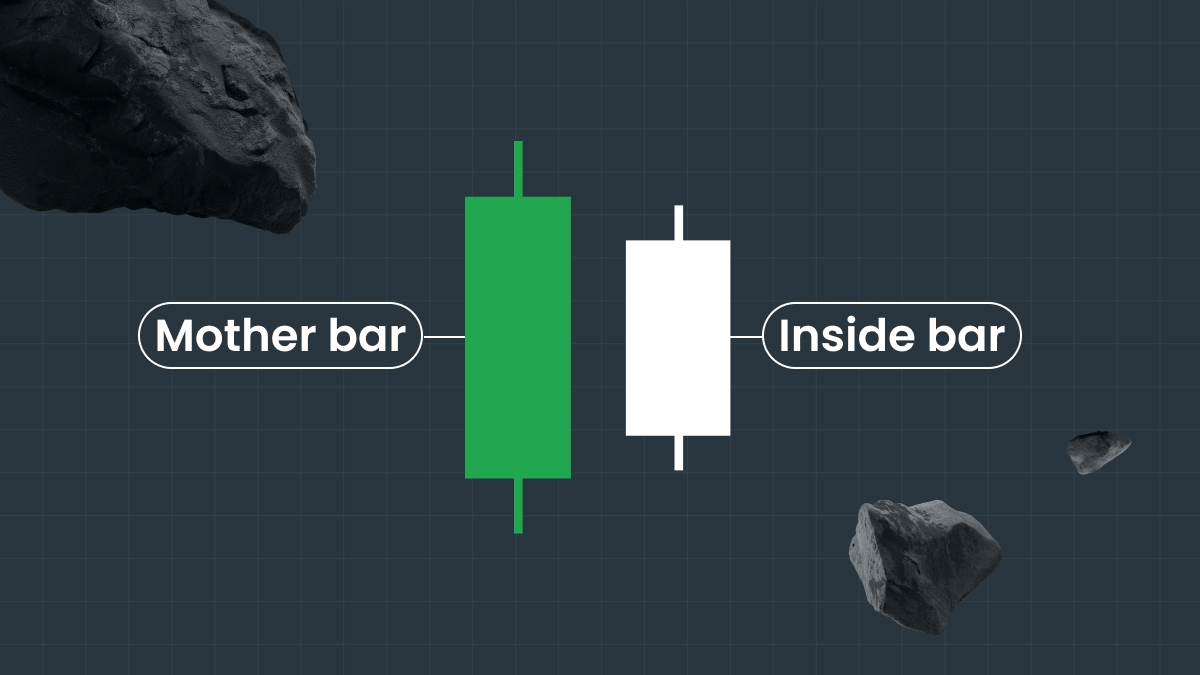

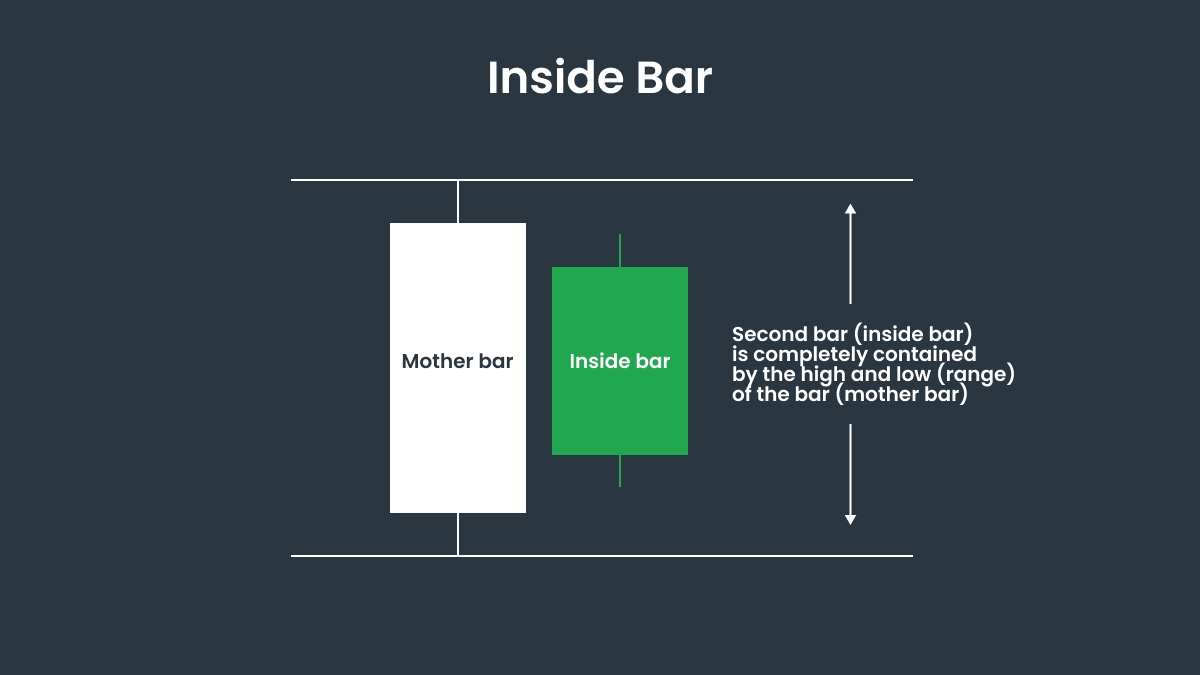

Finding Inside Bars on a chart is pretty straightforward once you know what to look for. You don’t need to check any indicators or make complicated calculations, you can simply spot them with your eyes. Scan the chart and look for a smaller candle that’s completely enclosed within the one that came right before it. It should have a smaller range and body, with a higher low and lower high.

Note: Just because you see an Inside Bar doesn’t mean it’s a good idea to trade it.

Context is important, so there are a few things to keep in mind. Inside bars tend to form around resistance and support levels, so you can keep an eye out for those. It’s also a good sign if you see them forming during a strong trend, because it means that the market is taking a breather. Wait while the price consolidates and the Inside Bar gets compressed.

After the Inside Bar settles, wait for confirmation. Once you see the third candle breaking out higher or lower, that could be a great opportunity to jump in and follow the trend, using a stop-loss to manage risk. If you’re going long, place your entry slightly above the Inside Bar’s high, and if you’re going short, enter just below its low.

Your stop-loss could be set just beyond the mother bar’s low if the trend is upward, or at the mother bar’s high if the trend is downward. This can give your trade room to breathe without being stopped by small price fluctuations. When it comes down to taking profit and closing your position, you can set a limit at the next logical level. This could be a previous high, a resistance area, or even a trendline.

Inside bars work best when everything lines up for a good setup. Make sure you identify a strong trend with clear momentum and potential resistance or support levels. It’s also a good idea to pair them with other tools such as trendlines and the Relative Strength Index (RSI). If you spot a bullish Inside Bar pattern and the RSI is showing the asset is oversold, that adds weight to the idea that the price will break out even higher. If you see an Inside Bar form during a choppy, sideways market, you might want to ignore it. When that happens, breakouts are less reliable and can fake you out more easily.

Inside Bar trading examples

A bullish Inside Bar continuation on the EURUSD daily chart

On this EURUSD daily chart, the market is shown climbing steadily, making higher highs and higher lows. An Inside Bar pattern forms, with a red mother bar and a smaller Inside Bar. The price pauses, and the next candle breaks above the Inside Bar’s high at 1.14865. A trader can enter a long position here, with a stop-loss just below the mother bar’s low at 1.13712, and a limit to take profit around the previous swing’s high of 1.18039.

A bearish Inside Bar on the GBPUSD daily chart

The GBPUSD chart below shows a large red candle appearing during a strong downtrend. The price then pauses with the formation of a smaller candle, the Inside Bar. The price settles for a bit, until a candle breaks below that Inside Bar’s low at 1.32308, confirming that the bears are still in control. That can be a good entry for a short position, with a stop-loss set just above the mother bar’s high at 1.35491. A limit can be set for profit taking at the next support level, around 1.25737.

Common mistakes to avoid

There are some common mistakes you should avoid making when trading Inside Bar candles.

The first one is treating every single Inside Bar as a signal. That’s risky because sometimes patterns will form randomly as noise or not lead to what you are expecting at all. You therefore always have to look at the bigger picture and check for validation, such as whether the pattern forms during a trend, whether there is clear momentum, and whether it’s formed around a support or resistance level.

Unless you have a good reason to, trading against the trend tends to also be a mistake. Knowing the context and checking for confirmation with other indicators is no guarantee that the trade will work, but you can at least be sure that it will have a stronger probability of success because it will be based on actual data and not placed at random.

Another common mistake is setting your stop-loss too close, right at the edge of the Inside Bar’s high or low. This can be risky because a minor price flicker can trigger the stop-loss and pull you out of the trade even though your setup was solid.

Finally, traders sometimes make the mistake of jumping in too early. Just because you spot an Inside Bar doesn’t mean you should act on it right away. It can be good to wait for the breakout candle to show after the Inside Bar. If it is pushing up or down with real momentum, it can be confirmation that the breakout is indeed taking hold. It’s always better to miss a trade than to make a hasty one or get into it at the wrong time.

Final Thoughts

Inside Bar patterns give you a clean view of what the market is thinking at that moment. They’re a kind of moment of hesitation, while pressure builds up before breaking into the next move. When used in the right context, they can be a great, low-risk tool for finding good entry points and catching trends early or riding them for longer.

Inside Bars are popular because they aren’t complicated, and you don’t have to hit yourself over the head with a lot of complex calculations. The main thing is to stay patient and wait for good setups. This kind of pattern doesn’t appear every five minutes, so this strategy can be a little time-consuming. You have to be patient and see them as part of a bigger picture. It’s one thing to identify the pattern, and it’s another to actually know what it means in that specific context.

Knowing about them and what they mean can help you spot them when they do form, and to understand how to trade them if you choose to. Trading isn’t about constantly making trades just to make trades, but about finding the right opportunities and knowing what to do with each one, all while managing risk. Once you’ve got this down, Inside Bar pattern trading is just another card you can add to your deck of skills to use with confidence when the timing and conditions are right.